Overview

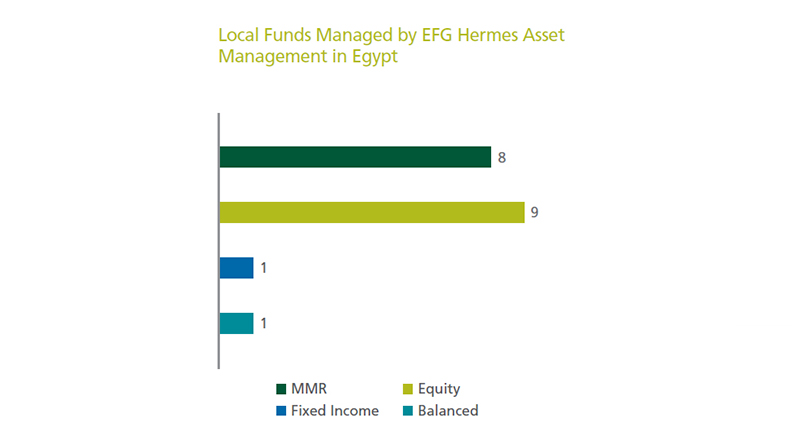

EFG Hermes Asset Management is the only asset manager in the MENA region with an established track record as an investment manager, with the division’s funds consistently outperforming regional benchmarks. Throughout its decades-long track record in the industry, the division has offered its diverse client base a wide spectrum of mutual funds and discretionary portfolios with both country-specific and regional mandates. The division’s mandates range from equity, money market, fixed income, and indexed to Sharia- and UCTIS-compliant mandates. The team serves a growing roster of clients, with a specific focus on long-term and institutional investors, offering tailored products accounting for individual needs, unique financial objectives, and risk appetites.

Operational Highlights of 2020

2020 saw the MENA region face unprecedented challenges, including lockdowns that impacted economic activity and a general slump in investor appetite for the emerging market asset class. Despite challenging market conditions due to the COVID-19 pandemic and dwindling sentiment, EFG Hermes Asset Management’s fund and portfolio performance continued to beat peer averages, allowing the division to maintain its standing as the region’s asset management house of choice.

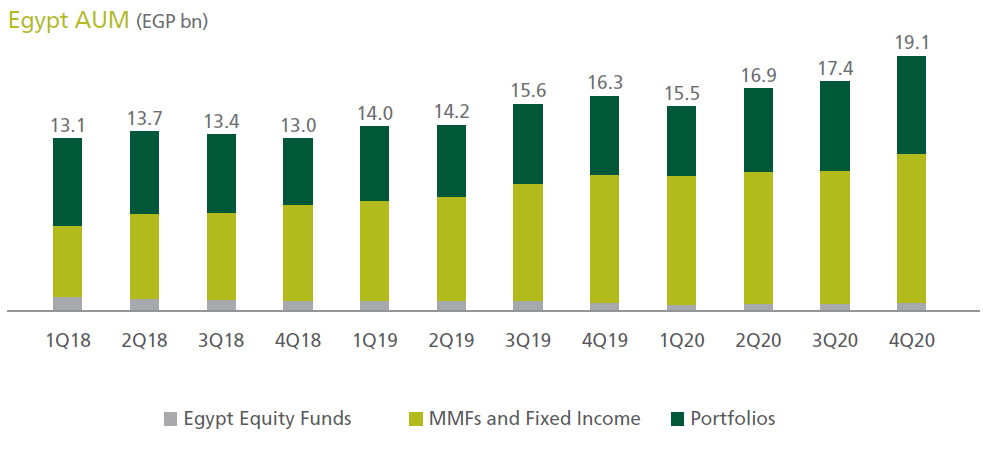

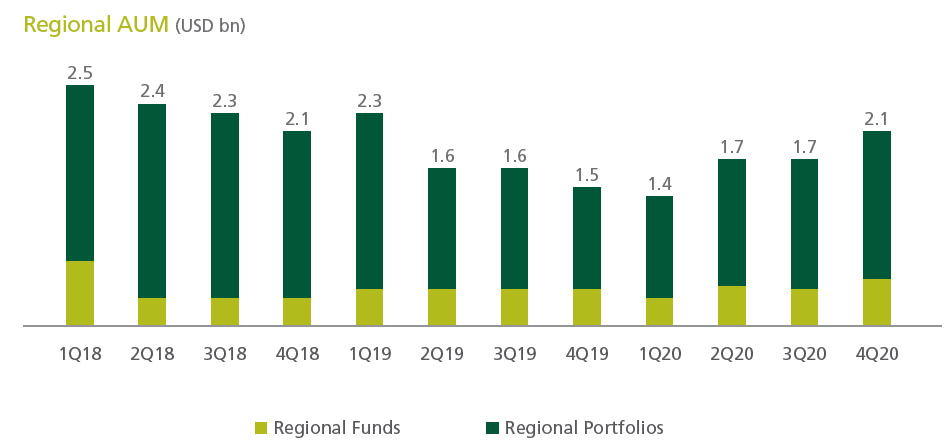

During the year, Egypt’s AUM rose 17.2% Y-o-Y to EGP 19.1 billion on the back of MMFs and stronger performance from equity markets as sentiment picked up toward the end of the year. In terms of regional performance, the division saw AUM up 40% in FY2020 to USD 2.1 billion, with strong performance across all funds and managed accounts as markets recovered towards the end of the year, recovering from the sell-off seen in March due to COVID-19.

In 2020, the Credit team laid the groundwork to launch new investment products to cover the emerging market asset class, considering the expected pickup in inflows in the region with an eye to satisfying the unique and evolving needs of its clients and solidify its position at the forefront of the competitive asset management space.

Key Financial Highlights of 2020

Asset Management revenue rose 28% Y-o-Y in FY20 to EGP 413 million compared to the EGP 321 million reported in FY19 largely due to strong incentive fees booked by the regional asset management, FIM in the final quarter of the year.

Awards

Due to its continued resilience in the face of the current market climate and its comparatively superior performance to regional peers, EFG Hermes Asset Management was named Best Asset Manager in Egypt and Pan-Africa by the EMEA Finance African Banking Awards 2020 for the second year running, as well as the Best Asset Manager in the UAE by the EMEA Finance Middle East Banking Awards.

2021 Outlook

We are optimistic about what the year ahead holds for both emerging and frontier markets, expecting to see solid inflows continue from their pickup toward the end of 2019 as markets began to find their footing once again. The division enters the new year confident that its solid fundamentals and decades of experience navigating macroeconomic and geopolitical headwinds will see it continue to grow and deliver value to its stakeholders regardless of the operating environment. As such, in the new year, the division will press on with product diversification strategy to solidify its position as the region’s leading asset management house by continuing to provide clients with a breadth of service offerings catered to their needs.